tax per mile california

Tax Per Mile California. Today this mileage tax.

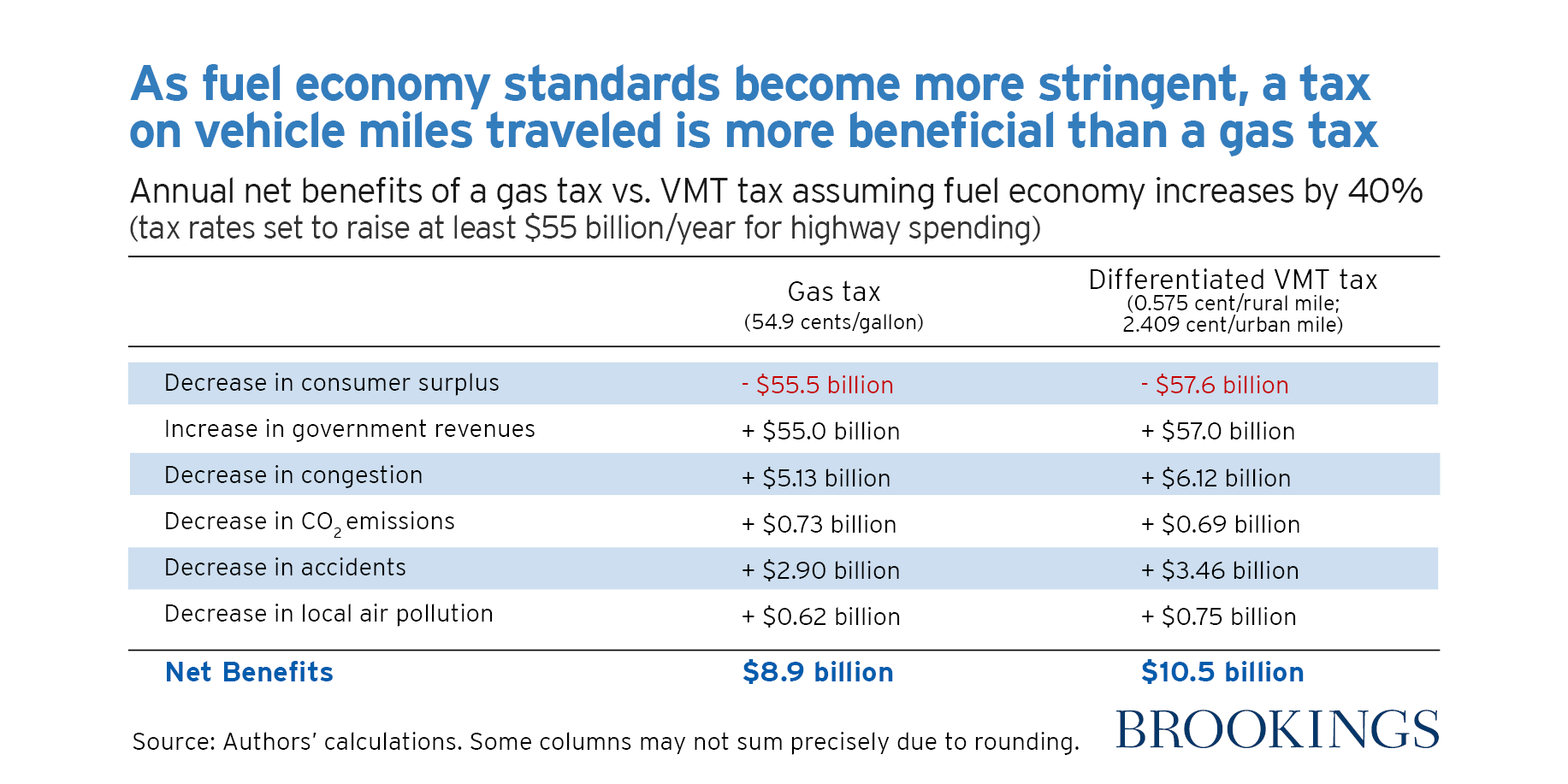

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

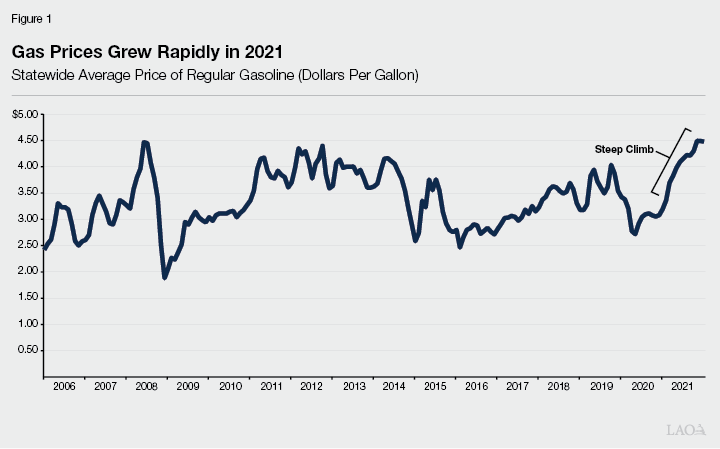

The California excise tax on gas will automatically rise again to.

. A mileage tax would not be calculated on a per gallon basis. Other states have been looking into switching to a per-mile road tax but California appears to be the first to look at point-of-purchase technology in recent years Pourvahidi said. Instead it would be calculated on a per mile basis.

What is Road Charge. California Considers Mileage Tax. Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program.

The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan. The average American drives thirty miles a day round trip to work and in California that average is significantly higher. Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy.

At a fee of 18 cents per mile driven which has been. Replacing Californias gas tax. I voted no on SB339 a bad bill pursuing a.

Interstate User Diesel Fuel Tax Interstate User License. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. Now California politicians are proposing a costly and unfair new Mileage Tax charging you per mile that you drive. Someone driving about 11500 miles a year.

California relies on gas tax and other fuel tax revenues to fund its roadway maintenance and repairs. Also will citizens get to vote on this. Commuting is a necessity in my district and a per-mile tax would be a huge blow to middle-class families Wilk said on Twitter.

Hence all vehicles will have to pay the same amount as mileage tax regardless. The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022. 005 per mile would end up as a massive increase in the taxes you are paying.

The undersigned certify that as of June 18 2021 the internet. The program is a voluntary option for drivers of eligible vehicles to pay their highway use fee on a per-mile basis. In Depth Recent News.

California wanted to tax space shuttles for every mile they travel upward into. Oregons tax rate of 18 cents per mile is equivalent to the 36-cent gas tax paid by a vehicle that gets 20 miles per gallon. Posted by 4 years ago.

I have been resisting against all common sense leaving California completely. I dont want to sell my home but it is time. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

The statewide tax rate is 725. Since 2015 the program allows the state to study a road. The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes building out.

Forget the gas tax. The proposal running around the Biden Administration is to impose a tax on every mile you drive. California Fuel Trip Permit CFTP For additional information on different types of licenses or permit please visit the Getting Started.

California will be losing. California Considers Mileage Tax. In addition to the 184 cents a gallon federal fuel tax Californias drivers pay 511 cents per gallon in state gas taxes plus state and local sales taxes.

Those district tax rates range from 010 to. Your vote on state and local races in. What the county believes is just a 2-cent addition piles up to create around 075 per mile including an existing state-level gas tax of 0511 per gallon that increased last week.

October 1 2021. But as cars get more fuel efficient or use other energy sources the. Proponents argue that the state gasoline tax of 529 cents per gallon.

California Department of Tax and Fee Administration. And not someones 2 seater. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a.

The plan known in transportation circles as Vehicle Miles Traveled VMT has faced opposition in Washington where it has been floated as alternative to the 184 cents per. If your car gets 24 mpg now youd be paying 120 in tax based on mileage vs the 060 if paying per gallon. It is also a way for the state to collect taxes from motorists who are buying and driving electric vehicles.

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

Irs Raises Standard Mileage Rate For 2022

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund

How Much Does An Electric Semi Really Cost International Council On Clean Transportation

Understanding California S Property Taxes

What Are The Mileage Deduction Rules H R Block

Motor Fuel Taxes Urban Institute

Understanding California S Property Taxes

Understanding California S Property Taxes

States With Highest And Lowest Sales Tax Rates

U S States With The Highest Gas Tax 2022 Statista

U S States With The Highest Gas Tax 2022 Statista

Understanding California S Property Taxes

What Are California S Income Tax Brackets Rjs Law Tax Attorney

The 2022 23 Budget Fuel Tax Rates

It S Been 28 Years Since We Last Raised The Gas Tax And Its Purchasing Power Has Eroded

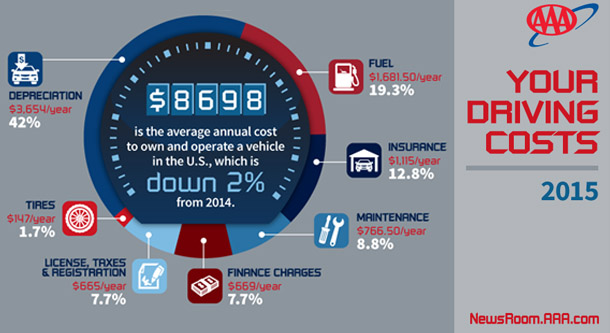

Annual Cost To Own And Operate A Vehicle Falls To 8 698 Finds Aaa 2015 Your Driving Costs Aaa Newsroom

The Uber Lyft Ballot Initiative Guarantees Only 5 64 An Hour Uc Berkeley Labor Center